Unconventional Foreign Exchange Interventions and Anticipated Inflation

Last year, Georgia experienced double-digit consumer price growth dynamics. During the same period, the inflation rate remained stubbornly high, persisting at 10.0% for nearly 1.5 years. However, as of this moment, the general price level has significantly decreased, and in August 2023, the annual inflation rate was just 0.9%. In response to this favorable trend, the National Bank of Georgia initiated a monetary policy easing. Since May 2023, the key interest rate has been reduced by 0.75 percentage points. The acting President of the National Bank, while announcing the latest cut in the key interest rate, pledged further relaxation of monetary policy.

Indeed, the current inflation rate permits a degree of monetary policy easing, though not to the extent we have seen currently. The National Bank has at its disposal various tools beyond open market instruments, such as refinancing loans and securities, as well as currency trading. When the National Bank buys foreign currency on the market, it engages in quantitative easing, as it involves the issuance of GEL. Recently, the National Bank has been actively pursuing quantitative easing through this instrument, which was widely employed even before the key interest rate cuts. Therefore, the actual relaxation of monetary policy began earlier than officially declared.

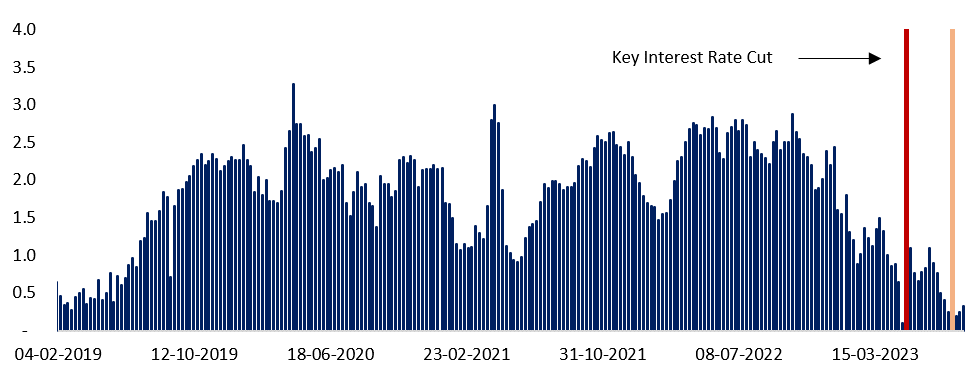

Simultaneously, foreign exchange interventions have become so frequent and extensive that one could argue the National Bank has essentially replaced significant monetary instruments with these interventions. This is further supported by the noticeable decrease in refinancing loans, even in the face of a key interest rate reduction (see Graph 1). This implies that foreign exchange interventions have evolved into a significant source of GEL for commercial banks.

Graph 1: Refinancing Loans (GEL Billion)

Source: National Bank of Georgia

Conversely, currency interventions, particularly the purchase of USD in the market, are reflected in the ongoing nominal exchange rate of the GEL and will have future implications for inflation. All else being equal, the National Bank's acquisition of USD will result in the depreciation of the GEL against the USD and subsequently contribute to general price increases in the economy due to increased GEL issuance. Furthermore, the National Bank's active involvement in currency market interventions does not align with the declared monetary policy framework and exchange rate regime.

Georgia operates a floating exchange rate system, where the nominal exchange rate of the national currency is determined by market forces. The National Bank emphasizes that it "does not in any way influence the exchange rate determination process". However, the actual situation differs. The National Bank steers monetary policy, which inherently has a direct impact on the exchange rate. Thus, through the use of various monetary instruments, including foreign exchange interventions where the National Bank either sells or buys national or foreign currency in the market, the National Bank becomes a participant in the market, affecting both the supply and demand sides. The greater the National Bank's participation in currency transactions, the greater its influence on the exchange rate.

In the years 2017-2019, the National Bank extensively purchased USD in the market, whereas in 2020-2021, it took the opposite approach and sold USD. During the first period, the National Bank acquired USD 492.3 million through 36 market interventions, and in the second period, it sold USD 1,298.9 million through 38 interventions. In 2022, the National Bank sold USD 93.8 million in the market while buying USD 80.0 million. However, this doesn't imply that the National Bank conducted fewer currency interventions during the same period; quite the opposite—the National Bank was more actively involved in the market.

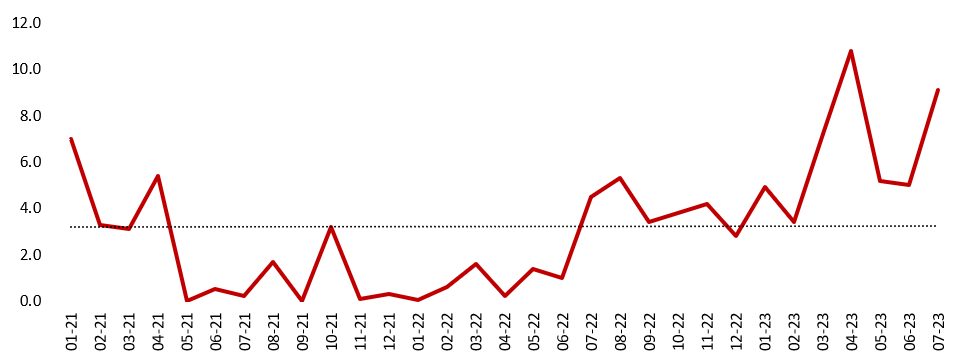

Graph 2: The National Bank’s Share in Foreign Currency Spot Trading (%)

Source: National Bank of Georgia

Due to active interventions, the National Bank's participation in currency market deals has increased significantly (see Graph 2). The National Bank's role in these trades became particularly pronounced in the latter half of the year, with the average monthly share rising to 4.0%. This year, the indicator has climbed even further to an average of 6.5%. This is a result of the substantial growth in the National Bank's foreign exchange interventions and not due to reduced activity from other market participants. However, during this period, the National Bank abandoned the traditional auction system in favor of the Bmatch currency trade platform. Since 2022, the National Bank has continued its foreign exchange interventions using this platform, with the scale of trade expanding on a monthly basis. It's worth noting that transactions for both buying and selling made through this system are not reported separately. Therefore, we only have access to the net figures of operations carried out by the National Bank since 2022.

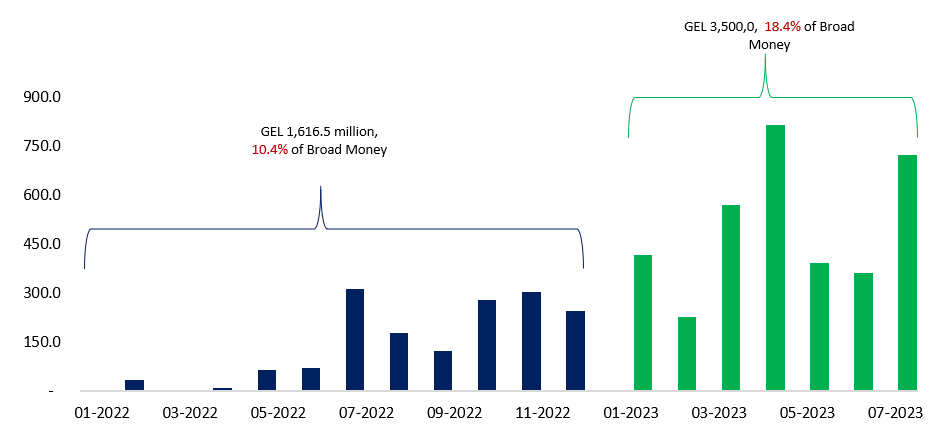

Graph 3: Issuance of the National Currency through Foreign Exchange Interventions (GEL Million)

Source: National Bank of Georgia; Author’s calculations

Since 2022, the National Bank has been engaged in the purchase of USD through the Bmatch platform in the currency market. The National Bank's net volume of foreign currency purchases via this platform reached USD 578.4 million over the past year. During the same period, the National Bank only bought USD 80.0 million and sold USD 93.8 million through the traditional auction system. In the first seven months of 2023, foreign exchange intervention volumes experienced a significant surge, with net currency purchases doubling to a total of USD 1,353.7 million. The most substantial portion of these purchases, USD 322.4 million, occurred in April 2023.

Foreign exchange operations serve as a monetary instrument that allows for the injection or withdrawal of liquidity from the banking sector. When the National Bank sells foreign currency in the market, it tightens monetary conditions, while purchasing foreign currency leads to monetary easing. Therefore, in the recent period, the National Bank's currency policy has had a pronounced effect on the easing of monetary policy (see Graph 3). For example, in 2022, the scale of monetary expansion through currency interventions amounted to GEL 1,616.5, which constituted 10.4% of the broad money supply at the beginning of the same period.

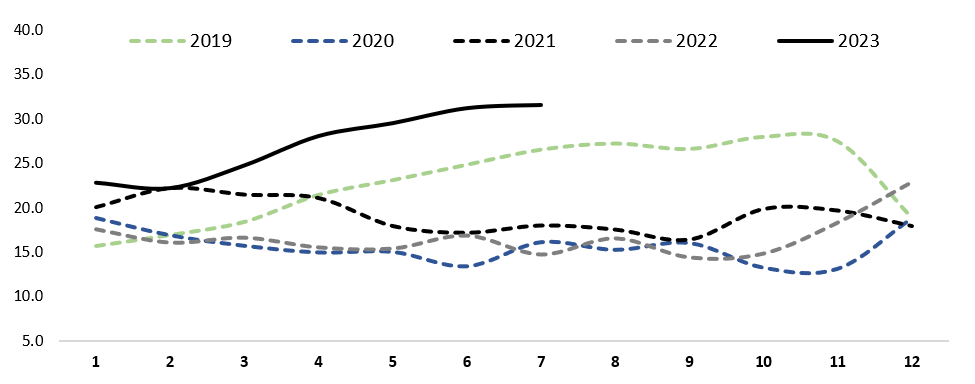

Graph 4: Annual Growth (%) of the Broad Money Aggregate (m2)

Source: National Bank of Georgia; Author’s calculations

The scale of foreign exchange interventions has seen a significant increase this year. In the first seven months alone, monetary expansion through currency interventions reached GEL 3,500.0 million, constituting 18.4% of the broad money supply at the beginning of the year. This represents a substantial monetary easing, and its impact on monetary aggregates is quite evident, as there are no signs of sterilization in the National Bank's actions. Monetary sterilization involves the withdrawal of additional GEL resources that were injected into banks through currency purchases. Meanwhile, the National Bank holds deposit certificates with an unchanged emission volume for the past few years, totaling GEL 260.0 million annually. In the first eight months of this year, the issuance volume stands at GEL 180.0 million.

Considering all the factors mentioned above, the growth dynamics of the broad money supply are significantly higher than in the previous period. As of July 2023, the annual growth rate of the M2 aggregate was 31.5%, and the year-to-date figure for the first seven months of this year is 27.2% (see Graph 4). In the past year, the average growth rate of the M2 aggregate was 16.7%, and over the last decade, it averaged 17.0%. Consequently, the National Bank's unconventional policy has resulted in unconventional monetary easing, the consequences of which will likely manifest as an acceleration in the general price level in the future.

See the attached file for the entire document with relevant sources, links and explanations.